2023 paycheck tax withholding calculator

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. 2022 Federal income tax withholding calculation.

What To Do When Employee Withholding Is Incorrect

Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to.

. Sign up for a free Taxpert account and e-file your returns each year they are due. Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Compare Prices Find the Best Rates for Payroll Services. This method of calculating withholding PAYG income tax instalments can vary from the annual tax amounts. Unemployment insurance FUTA 6 of an.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Wednesday September 28 2022 600 PM to 900 PM. Make Your Payroll Effortless and Focus on What really Matters.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Get Started With ADP Payroll. There are 3 withholding calculators you can use depending on your situation.

The result is net income. It takes the federal state and local W4 data and. Begin tax planning using the 2023 Return Calculator.

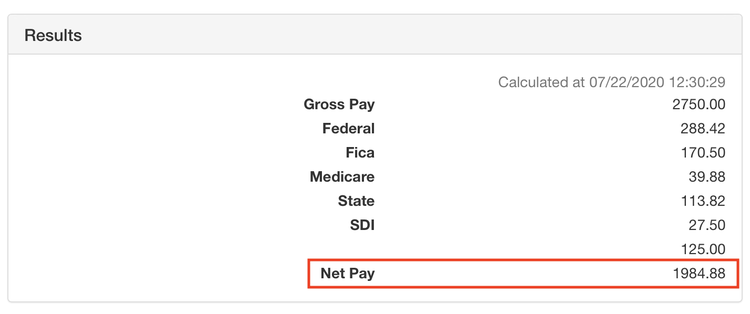

It will confirm the deductions you include on your. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Withhold 62 of each employees taxable wages until they earn gross pay.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Withhold 62 of each employees taxable wages until they earn gross pay. Discover ADP Payroll Benefits Insurance Time Talent HR More. This online tool guides users through the process of checking their withholding to help determine the right amount to withhold for their personal situation.

Web UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Corporate Activity Tax registration. Understanding California Payroll Tax Withholding Requirements Greater Long Beach Chapter In-Person Meeting Date.

Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee. Florida Paycheck Calculator 2022 - 2023 The Florida paycheck calculator can help you figure out how much youll make this year.

Begin tax planning using the 2023 Return Calculator. Get Started With ADP Payroll. Get a head start on your next return.

How to calculate annual income. IRS Form W-4 is. This calculator is integrated with a W-4 Form Tax withholding.

Get Started With ADP Payroll. Federal withholding calculator 2023 per paycheck Senin 19 September 2022 Florida employers are responsible for withholding and paying the same federal payroll taxes as. It can also be used to help fill steps 3 and 4 of a W-4 form.

Ad Process Payroll Faster Easier With ADP Payroll. Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

For example based on the rates for 2022. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Thats where our paycheck calculator comes in.

For example if an. Multiply taxable gross wages by the number of pay periods per year to compute. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum.

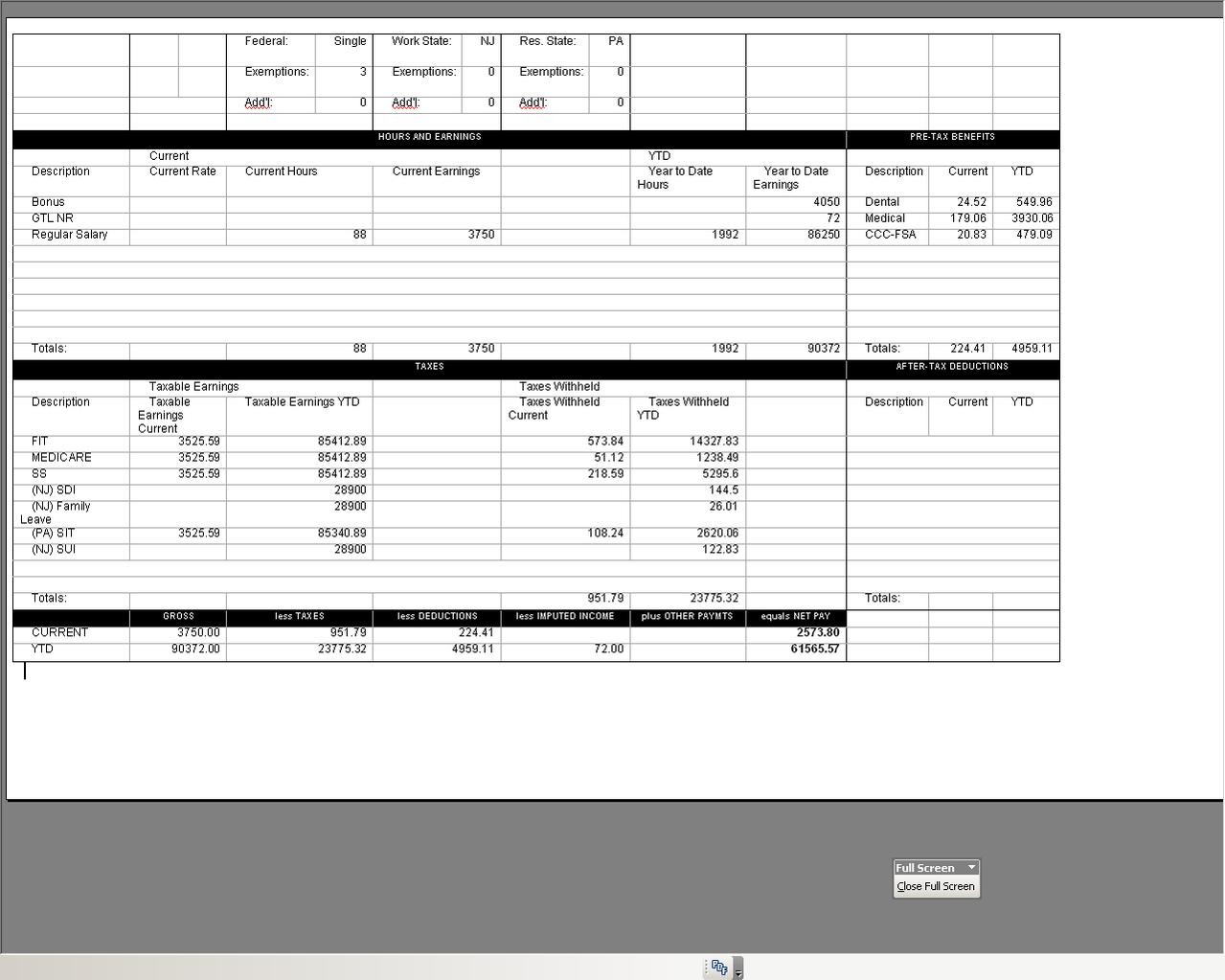

100000 Gross 84627 Net Definitions Year-to-date earnings Your current year gross earnings that were subject to FICA taxes Social Security tax and Medicare tax. Begin tax planning using the 2023 Return Calculator below. Ad Process Payroll Faster Easier With ADP Payroll.

Customers need to ensure they are calculating their payroll tax. 2023 paycheck calculator Rabu 07 September 2022 To receive a bigger refund adjust line 4c on Form W-4 called Extra withholding to increase the federal tax withholding for. Payroll withholding calculator 2023 Sabtu 10 September 2022 For example the 2022 to 2023 tax year starts on 6 April 2022 and ends on 5 April 2023.

Important note on the salary paycheck calculator. You will need to submit a. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2022 Federal Payroll Tax Rates Abacus Payroll

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Payroll Tax Vs Income Tax What S The Difference

What S The Most I Would Have To Repay The Irs Kff

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

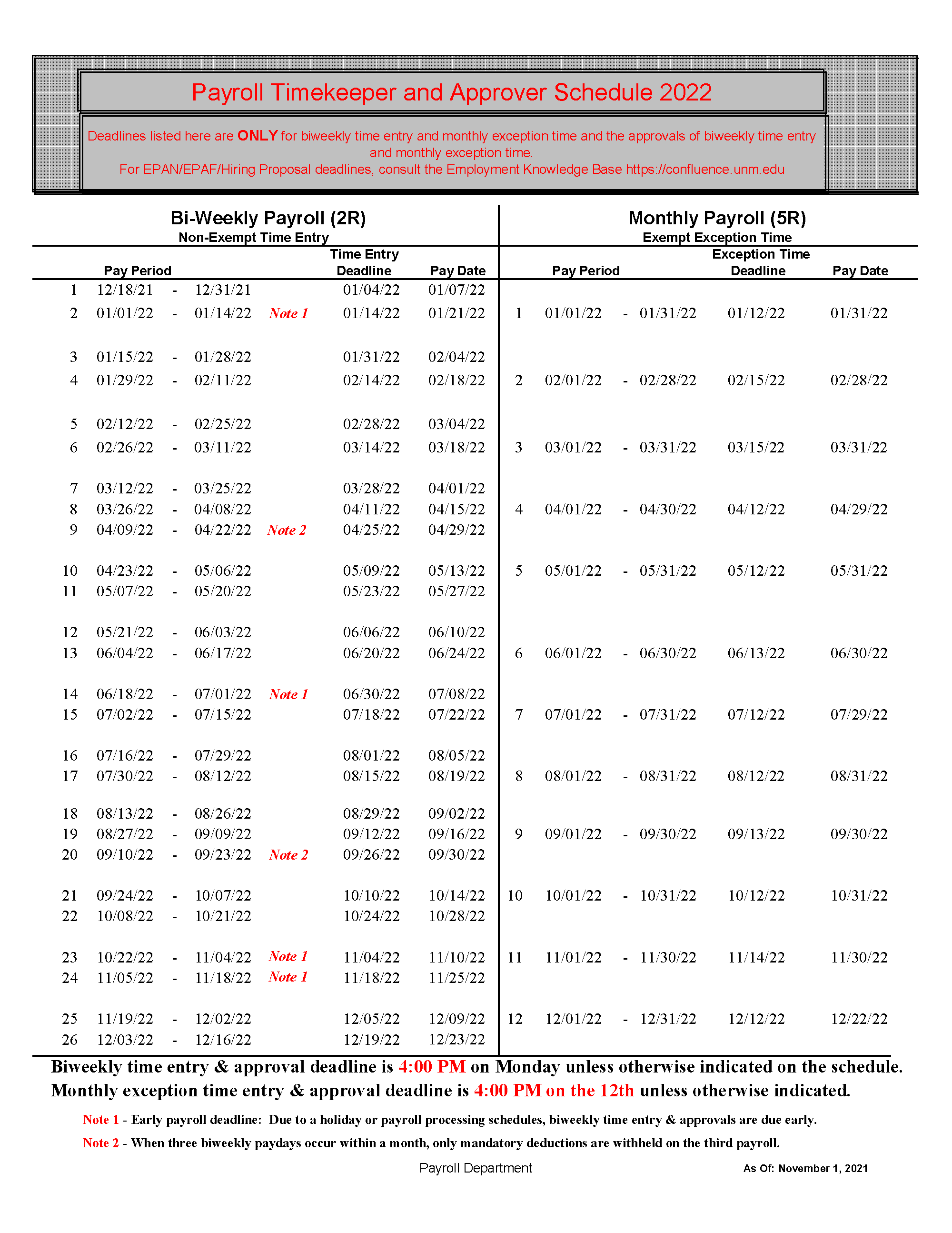

Pay Schedule Payroll Office The University Of New Mexico

Income Tax Poster Psd Template Income Tax Psd Templates Templates

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Payroll Template Free Employee Payroll Template For Excel

Paycheck Tax Withholding Calculator For W 4 Tax Planning

A Small Business Guide To Doing Manual Payroll

2022 Federal State Payroll Tax Rates For Employers

Tax Information Career Training Usa Interexchange

Estimated Income Tax Payments For 2022 And 2023 Pay Online